Monthly Archives: July 2013

Mortgage Rates Unchanged

Mortgage rates were essentially unchanged today, with some lenders in marginally better shape while others were marginally worse. Some of this discrepancy can be accounted for by mid-day reprices where lenders republish rate sheets on occasions where the mortgage backed securities market moves far enough in one direction. Lenders reprice at different times and under different circumstances, meaning that some underlying market movements can be bad enough to motivate some lenders to reprice.

The rest of the discrepancy is due to the fact that markets simply didn’t move much in the first place. Even without the reprices, some lenders were in better shape this morning while others were worse. For the most part, the differences are microscopic and the most prevalent 30yr Fixed quote for a top-tier scenario best-execution remains at 4.5%. Paying additional closing cost to move to 4.25% continues to make sense in some cases, but the amount of time required to break even (extra costs divided by monthly payment savings) is closer to 6 years in some cases compared to just under 5 years last week.

The rest of the week is pretty straightforward from a risk/reward standpoint. Both are huge and risk will continue to generally outweigh reward as long as interest rates continue to generally be trending higher. The steeper trends toward higher rates beginning in early May and late June have been consolidating since the July 5th blowout. “Consolidation” is just another way of saying “moving mostly sideways with plenty of ups and downs but generally with lower highs and higher lows.”

Rates can consolidate for several reasons, but one of the most common is simply because they are moving through a period of weeks that contain inconsequential information relative to some extremely important information. That’s probably what this consolidation owes itself to, and tomorrow is probably the day where we start getting that information. It’s not just one event either, but a rather impressive confluence of events including the Fed’s Policy Announcement, an important employment report, and first look at Q2 GDP among other things.

Markets are also cognizant that the mighty Employment Situation Report is released this Friday, and taken together with tomorrow’s events, should be plenty to suggest the next move higher or lower from this consolidative perch. That’s all well and good if the data and events work in favor of lower mortgage rates or even if they’re at odds in such a way that rates can at least stay flat, but the risk is that the data is unified in suggesting higher rates. If that happens, it could happen BIG, and this afternoon would be the time where you’d wish you would have locked. On the flipside, you could lock today and regret it if rates are able to make a more meaningful recovery, but that’s a different kind of regret than the “wish I would have locked” kind.

Today’s Best-Execution Rates

•30YR FIXED – 4.5%

•FHA/VA – 4.25%

•15 YEAR FIXED – 3.625%-3.75%

•5 YEAR ARMS – 3.0-3.25%

For more information visit http://www.mortgagessiny.com

The Week Ahead

The Week Ahead: More Of Everything

Monday – Pending Home Sales at 10am is the only relevant piece of economic data in the US session. Even Pending Sales wouldn’t typically be too interesting, but the housing market is back as a potential consideration for Fed policy, and the purchase market is of particular interest (as a steep drop-off in refinance demand is not much of a surprise given the recent rise in rates).

Tuesday – The pace pics up, though not by much. Case Shiller Home Prices report at 9am, and while the effects of rising rates on purchases and prices is interesting, this price data is for the month of May, not capturing the brunt of the rate movement. Consumer Confidence at 10am is the most significant economic release by that point in the week, and the FOMC begins it’s two day meeting. This will also be the last chance to catch your breath (or lock) before the potential volatility sharply increases early Wednesday morning.

Wednesday – In the 8:15am time-slot, the increasingly well-regarded ADP Employment report stands the chance of inspiring quick changes in the outlook for the week’s headline event (Friday morning’s NFP). When ADP misses/beats big enough, it can have a big effect on trading levels, but it’s not the only thing going on that day. 15 minutes later, Q2’s first GDP reading comes out. Economists expect +1.0 compared to Q1’s final reading of +1.8. Chicago PMI hits at 9:45am (and can cause volatility at 9:42am when subscribers get the data 3 minutes early), but the day’s STILL not remotely through with potential market movers. The ‘biggie’ comes at 2pm with the FOMC Announcement. While the notion is on the table that the Fed will make some changes to the announcement that attempt to sooth recent volatility, there’s just as much chance that the text remains relatively unchanged. The latter suggests a more muted response, and even a surprise change wouldn’t pack its normal punch with Friday’s NFP on tap. To top all of the preceding off, this is also “month-end,” creating extra hustle and bustle in financial markets as money managers make last minute adjustments to portfolio balances in order to align them with various indices. This doesn’t have a default positive or negative connotation.

Thursday – Initial Jobless Claims at 8:30am is moderately important, but not critical ISM Manufacturing is the most relevant data point of the day at 10am with the Employment Index (component of ISM data) getting perhaps as much attention as the headline.

Friday – Incomes/Outlays (essentially ‘consumer spending’) and Factory Orders are second string reports compared to the mighty Employment Situation Report. Not only is it always the biggest potential market mover of any given month in terms of market data, but it’s importance is magnified by its current role in Fed policy. Put simply, as long as the jobs report keeps on track just under 200k payrolls, markets will continue to expect the Fed to announce the first reduction in QE3 asset purchases at the September policy meeting.

for more information visit http://www.mortgagessiny.com

Mortgage Rates Start Higher, End Flat

Mortgage rates began the day moderately higher, but as market conditions improved most lenders released improved rate sheets bringing offerings more in line (or slightly better than) yesterday’s. This keeps the 30yr fixed best-execution rate at 4.5%, though buying down to lower rates can make sense in some cases. For the first this week, lender pricing strategies are highly stratified. This simply means that some are in noticeably better territory, some are almost imperceptibly stronger, and a few others either have yet to reprice or haven’t quite caught up with the rest of the pack yet.

Today’s economic data was not a significant motivation for interest rates though the completion of the week’s Treasury auctions helps take some supply pressure off bond markets. Treasury supply is just like anything else in terms of “supply and demand.” As it increases, prices fall, and falling prices in bond markets mean higher rates. MBS (the “mortgage-backed-securities” that most directly influence mortgage rates) tend to move in the same direction as Treasuries (just like stocks in the same sector tend to move in the same direction unless there’s company-specific news that affects one over the other).

It’s not as if markets aren’t planning on this new supply coming to market, but there’s always some amount of variability as to how other auction participants will bid. In general, markets are slightly less aggressive in buying Treasuries until auctions are complete, allowing for some of that demand to come back into view. This doesn’t mean nearly as much as it sounds like it might, but is just another small piece of today’s ability to hold its ground against the past two days of weakness. In general, we continue to be in a wide, sideways range ahead of next week’s more important events, with possibilities that rates can move in either direction in the meantime.

For more information visit http://www.mortgagessiny.com

New U.S. home sales vaulted to a five-year high in June, showing no signs of slowing in the face of higher mortgage rates.

New U.S. home sales vaulted to a five-year high in June, showing no signs of slowing in the face of higher mortgage rates.

Other data on Wednesday showed an acceleration in U.S. factory activity this month, boosting hopes of a third-quarter pick-up in economic growth.

Single-family home sales increased 8.3 percent to a seasonally adjusted annual rate of 497,000 units, the highest level since May 2008, the Commerce Department said. Sales rose 1.3 percent in May.

Economists polled by Reuters had expected new home sales to advance to a 482,000-unit rate last month.

Compared with June last year, single-family home sales were up 38.1 percent, the largest increase since January 1992.

The third straight month of gains in new home sales, which are measured when contracts are signed, suggested the housing market was gaining more muscle and should allay concerns that higher mortgage rates could slow down momentum.

There had been worries that higher borrowing costs could crimp the housing market recovery after data on Monday showed a surprise drop in home resales in June.

Mortgage rates have been rising in anticipation of the Federal Reserve starting to reduce its massive monetary stimulus later this year. According to Freddie Mac, the 30-year fixed mortgage rate increased 0.53 percentage point in June to 4.07 percent, its highest level since October 2011.

Still, mortgage rates remain low and Fed Chairman Ben Bernanke last week expressed optimism the housing market recovery would continue.

The strengthening housing market is lending support to manufacturing, which has been hit by deep federal government spending cuts and slowing global demand.

A rebound in new orders helped to lift factory activity to a four-month high in July. Financial data firm Markit’s “flash,” or preliminary, U.S. Manufacturing Purchasing Managers Index, rose to 53.2 this month from 51.9 in June.

A reading above 50 indicates expansion in the factory sector.

U.S. financial markets were little moved by the data.

While the inventory of new homes on the market last month increased to its highest level since August 2011, supply remains tight, putting upward pressure on prices. The median new home price increased 7.4 percent in June from a year ago.

At June’s sales pace it would take 3.9 months to clear the houses on the market, down from 4.2 months in May. A supply of six months is normally considered as a healthy balance between supply and demand

For more information visit http://www.mortgagessiny.com

Refi Demand Falls to 2-yr Lows, Dragging Down MBA Survey

Purchase applications shored up application volume during the week ended July 12 after four straight weeks of decline. Refinancing activity continued to react to increased rates and seasonally adjusted figures from the Mortgage Bankers Association’s (MBA’s) Weekly Mortgage Application Survey were muddied a bit by adjustments to the previous weeks figures because of the July 4 holiday.

MBA’s Market Composite Index, a measure of that application volume, decreased 2.6 percent on a seasonally adjusted basis from the week ended July 5 however it increased 22 percent on an unadjusted basis, the first increase in five weeks.

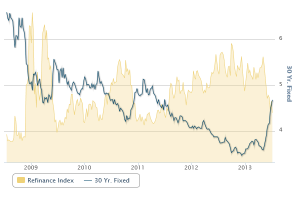

The Refinance Index was down 4 percent from the previous week and is at its lowest level since July 2011. Refinancing dropped to a 63 percent share of all application activity, its lowest level since April 2011 from a 64 percent share the previous week. Thirty-four percent of refinancing applications were for the Home Affordable Refinance Program (HARP) compared to 35 percent the week before.

Refinance Index vs 30 Yr Fixed

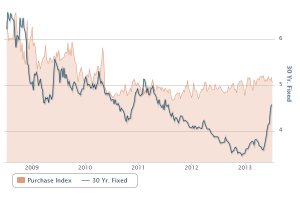

The seasonally adjusted Purchase Index increased 1 percent from one week earlier but the unadjusted Index jumped 26 percent compared with the previous week and was 5 percent higher than the same week one year ago.

Purchase Index vs 30 Yr Fixed

Contract interest rates which had risen sharply for several weeks were mixed during the week while effective rates all declined. The average contract interest rate for 30-year fixed-rate mortgages (FRM) with conforming loan balances ($417,500 or less) was unchanged at 4.68 percent,with points decreasing to 0.42 from 0.46. The interest rate for the jumbo 30-year FRM (loan balances over $417,500) decreased to 4.81 percent from 4.86 percent and points increased to 0.40 from 0.37. FHA-backed 30-year FRM had a contract rate of 4.38 percent with 0.22 point compared to 4.37 percent with 0.39 point the previous week.

The average contract interest rate for 15-year fixed-rate mortgages dropped 6 basis points to 3.70 percent. Points decreased to 0.38 from 0.41.

The average contract interest rate for 5/1 adjustable rate mortgages (ARMs) slipped to 3.39 percent from 3.40 percent and points fell to 0.37 from 0.54, The ARM share of activity increased to 7 percent of total applications.

Rates quoted are for 80 percent loan-to-value ratio mortgages and points include the origination fee.

MBA’s Weekly Mortgage Applications Survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

an article by Jann Swanson

http://www.mortgagenewsdaily.com/07172013_application_volume.asp

for more information visit http://www.mortgagessiny.com

“Taper Talk” Hurts, But Not Enough to Stall Recovery – Freddie Mac

Freddie Mac calls “Taper Talk” is the main topic of conversation in the financial world, that is, speculation about the timing and speed that the Federal Reserve will employ as they scale back their policy of quantitative easing. ” This speculation has prompted the recent roller coaster in interest rates and a ride where the exit will be at a higher rate level than the entrance,” the company’s chief economist Frank E. Nothaft and deputy chief Leonard Kiefer say in the current issue of Outlook.

Echoing similar analysis from Fannie Mae out this morning, Freddie says that while higher interest rates on mortgages will slow the housing recovery, they are unlikely to stop it in its tracks. In the first half of this year the economy added 1.2 million net jobs, the best pickup in nonfarm payrolls for a similar period since 2005. More than 100,000 construction jobs were added due to a spike in housing starts and the increase in employment will mean more Americans will have the resources to form separate households and further bolster housing demands. Nothaft and Kiefer say they expect this pace in job growth to continue in the second half, making 2013 the best year for growth since 2005.

They don’t, however, expect the rapid pace of home price appreciation to continue at the double digits annual increases of recent months. Seasonally adjusted values were up about 5 percent in just the first half of 2013 but will likely moderate to 3 to 4 percent in the second half for an annual gain of 8 to 9 percent for the year and then settle in around 3 percent in subsequent years. When adjusted for a 2 to 2.5 percent inflation rate this will make real appreciation about 0.5 to 1 percent per year, about in line with historic numbers.

Sales likewise have increased dramatically, up over 10 percent in the first five months of this year compared to the same period in 2012 and new home sales are up 29 percent. The volume of new home sales have led to a 24 percent increase in single-family housing starts and the above referenced new construction jobs. And likewise the Freddie Mac economists do not anticipate this surge will continue. They anticipate sales of new and existing homes to add an additional 2 percent this year and to rise 12 percent relative to the first half of the year.

for more information visit http://www.mortgagessiny.com

http://www.mortgagenewsdaily.com/07162013_freddie_mac_forecast.asp

Mortgage Rates Still Dirt Cheap

Mortgage rates have skyrocketed over the past few months. Just one week ago, they set a record for the largest single-day increase in history, leading industry experts such as Matthew Graham, chief operating officer of Mortgage News Daily, to characterize it as a “catastrophic surge.”

The impact on the mortgage market can’t be denied. At the end of last week, the nation’s largest mortgage originator, Wells Fargo (NYSE: WFC ), reported that its mortgage refinancing volume had fallen by 23% in the second quarter compared with the same time period last year. And industrywide, data from the Mortgage Bankers Association estimates that the same figure is down by more than 50% since peaking seven months ago.

But what does this mean for prospective homebuyers? In a word: nothing, or at least, much less than one would instinctively conclude.

Even though mortgage rates have vaulted higher, the monthly payments on a $250,000 30-year fixed-rate mortgage remain historically low. At today’s rates — roughly 4.5% — the monthly payment would be an estimated $1,266. That’s 34% smaller than the average since 1976. In other words, mortgage rates are still dirt cheap

For more information and questions visit http://www.mortgagessiny.com

Mortgage Rates Bounce Back to Week’s Lows

Mortgage rates were lower today, continuing a move set in motion by comments from Fed Chairman Bernanke late in yesterday’s session. Markets didn’t have much time to react, but showed early hints at today’s strength in overnight trading. Some mid-day volatility forced a few lenders to adjust rates higher, but once it was resolved, even more lenders adjusted rates lower before the end of the day. The net effect is a 30yr fixed best-execution rate that’s more convincingly down in the 4.625% range, whereas some lenders were arguably near 4.75% yesterday.

Mortgage rate movement can be measured in two ways. Of course we can examine changes in the actual rate (which we extrapolate on our “mortgage rates” page), but lenders typically offer rates in increments of 0.125% or “an eighth.” The balance of day to day (and sometimes hour to hour) movement occurs in “cost.” This can refer to the upfront costs associated with buying down a rate or the amount of cash back otherwise received at closing. Today was one of those days where the movement was almost enough to simply say “rates dropped an eighth,” but not quite. As such, the reference to 4.75% yesterday versus 4.625% today doesn’t mean rates are simply an eighth lower, but it may have made a move down in rate affordable to the point that it’s worth the cost. Your lender will generally have the option to show you how adjacent rates will affect your upfront costs.

There’s the important Retail Sales report on Monday morning which may prevent rates from getting too low as market participants look to stay nimble ahead of the data

For more information or questions visit http://www.mortgagessiny.com

Appraisal Exemptions Proposed for High-Priced Loans

Regulators are proposing to exempt three types of loans from some of the appraisal requirements for so-called higher priced mortgages. The requirements are mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act for mortgages loans which are considered to be higher priced if they are secured by the borrower’s home and have interest rates above a certain threshhold.

The proposed exemptions do not affect the majority of residential loans covered under the regulation which goes into affect on January 18, 2014. Proposed for exemption from the appraisal requirements are:

• Transactions secured solely by an existing manufactured home and not land. The agencies propose to retain the appraisal requirement for loans secured by new manufactured homes but are seeking further comments on the scope of the exemption, whether certain conditions on the exemption might be appropriate, and if an alternative valuation should be required.

• Certain types of refinancings with characteristics common to what are commonly called “streamlined” refinances. Specifically the agencies propose to exempt a loan where the borrower or guarantor of the new loan is also the borrower or guarantor of the loan being refinanced. The new loan must not result in negative amortization, be an interest only loan, or result in a balloon papyment. Finally, the refinancing must not result in “cash-out” to the borrower or guarantor.

• Extensions of credit of $25,000 or less with that amount indexed every year for inflation.

The six regulatory agencies, the Federal Reserve System, Consumer Financial Protection Bureau, Federal Deposit Insurance Corporation, Federal Housing Finance Agency, National Credit Union Administration, and the Office of Comptroller of the Currency, are inviting public comment on the proposed exemptions. The deadline for those comments is September 9, 2013.

In announcing the proposed exemption the agencies state they are intended to save borrowers time and money and to promote the safety and soundness of creditors and are being issued in response to public comments previously received. The exemptions are proposed to go into effect at the same time as the governing rule, however the agencies say that if they should adopt any conditions affecting the exemptions they will consider establishing a later date for the conditions to allow creditors time to plan their compliance.

For more information and questions visit http://www.mortgagessiny.com

Rising Rates Taking Consistent Toll on Purchase Demand

Mortgage application activity continued to slide last week, down 4 percent on a seasonally adjusted basis from the week before, the fourth straight week the Mortgage Bankers Association’s (MBA’s) Market Composite Index has fallen. The index, a measure of application volume, contained an additional adjustment to account for the July 4 holiday. On an unadjusted basis the index was down 23 percent from the week ended June 28.

The Refinance Index was down 4 percent from the previous week and refinancing accounted for 64 percent of total applications, a slight week-over-week decline. Thirty-five percent of refinancing applications were for Home Affordable Refinancing loans, up from 34 percent the previous week.

Refinance Index vs 30 Yr Fixed

The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index was 23 percent below that of the previous week and was 5 percent higher than the same week one year ago.

Purchase Index vs 30 Yr Fixed

All average contract interest rates reported from MBA’s Weekly Mortgage Applications Survey hit near two year high levels and effective rates also all increased. The average contract rate for a 30-year fixed-rate mortgages (FRM) with a balance of $417,500 or less jumped 10 basis points to 4.68 percent. Points rose to 0.46 from 0.43. The jumbo FRM (balances over $417,500) rose from 4.68 percent to 4.86 percent with points down from 0.38 to 0.37. The rates for both conforming and jumbo FRMs were at the highest level since July 2011.

FHA-backed 30-year FRM were back to September 2011 interest rate levels, increasing 10 basis points to 4.37 percent. Points dropped to 0.39 from 0.44.

The average contract rate for 15-year FRM was 3.76 percent with 0.41 point compared to 3.64 percent with 0.44 point the week before. This was the highest rate since July 2011.

Adjustable rate mortgages drew a 7 percent share of mortgage applications during the week, down from 8 percent. The average rate for a 5/1 ARM increased to its highest level since May 2011, 3.40 percent, from 3.33 percent. Points jumped to 0.43 from 0.31.

visit http://www.mortgagessiny.com for more information.